Cookie Settings

Please allow us to collect data about how you use our website. We will use it to improve our website, make your browsing experience and our business decisions better. Learn more

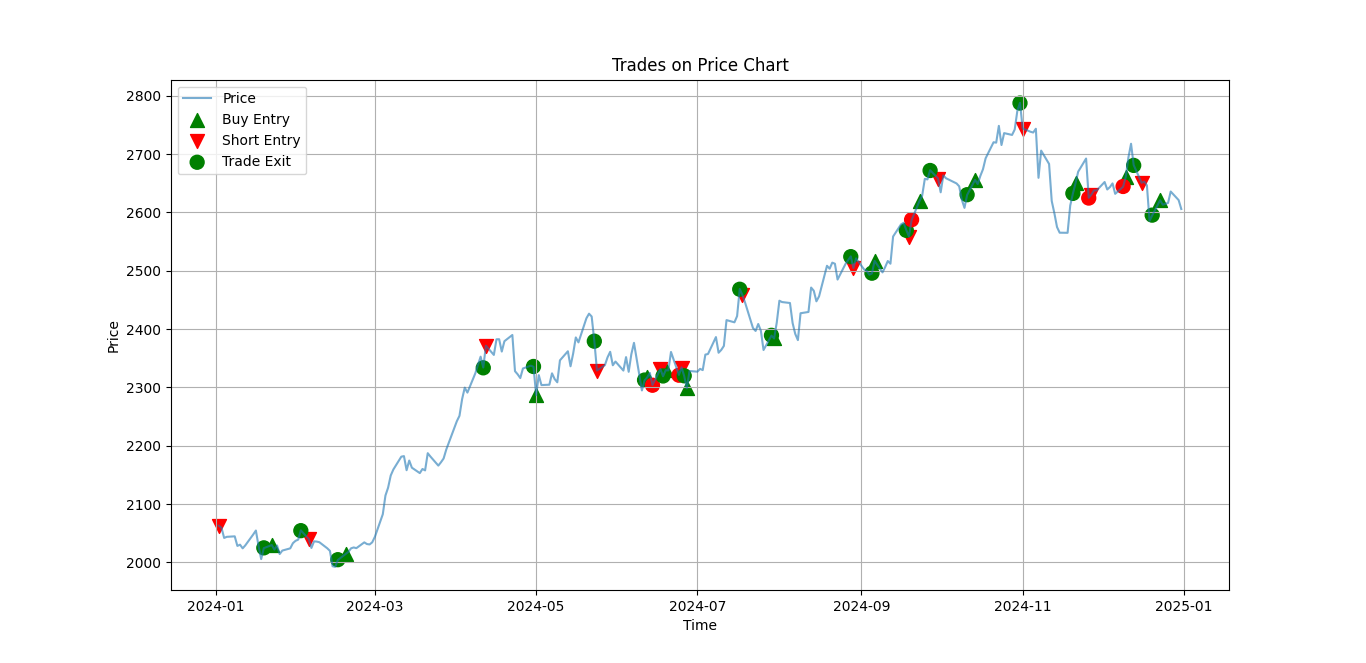

In a year marked by geopolitical tension, inflation battles, and monetary policy shifts, our AI-powered trading system delivered a record-shattering performance trading XAUUSD (Gold) — transforming a $1,000,000 starting capital into over $140,000,000 by year-end.

This isn’t a story of luck or hype. It’s the result of disciplined AI architecture, superior risk management, and strategic exploitation of Gold’s volatility across 12 historic months.

Gold (XAUUSD) is one of the most sentiment-driven and macro-reactive assets in the financial world — and our AI system thrives in exactly that kind of environment.

Here’s how we gained the edge:

🔁 24/7 Adaptive Algorithms reacting to shifts in global risk sentiment, Fed decisions, inflation, and more.

⏱️ High-frequency signal generation tuned for intraday and swing trades.

🛡️ Tight drawdown controls that allowed compounding without catastrophic loss.

📊 Multi-model intelligence: neural networks, volatility clusters, and predictive AI fused into a single decision engine.

Our AI doesn’t just "trade." It thinks, learns, and evolves. Some features that powered this year’s success:

Deep Neural Signal Filters: Filtered noise, focused on high-probability reversals.

Event-Aware Models: Adapted to news spikes and FOMC volatility within seconds.

Risk Optimizer AI: Adjusted lot sizes and stop-losses dynamically based on volatility metrics.

Multi-Timeframe Alignment: Scanned weekly, daily, and hourly charts for confluence before execution.

The result? Hyper-consistent profits. Negligible drawdowns. Zero overexposure.

| Metric | Result |

|---|---|

| Starting Balance | $1,000,000 |

| Ending Balance | $140,000,000+ |

| Total Return | +13,900% |

| Highest Profit | Over $30,000,000 |

| Highest Loss | Less than $100,000 |

| Worst Drawdown | < 1% |